Ideal Tax Solution

RESOLVE YOUR IRS TAX AUDIT

Experienced Tax Attorneys

FREE CONSULTATION & NO OBLIGATION

Your information is protected & safe with us

YOU MAY QUALIFY TO SUBSTANTIALLY LOWER YOUR TAX DEBT

As seen in the news:

Tax Debt is Heavy

Don't Carry it Alone

IRS ‘Fresh Start’ Qualification Assistance

If you’re experiencing or worried about liens, levies, garnishments, or more, now is the time to learn about your options to protect yourself and resolve your tax burden. Tax debt reduction programs under federal law provide real relief, but they can be very complexed to navigate. We can help you solve your IRS related issues by leveraging the law in your favor and potentially can save you thousands of dollars.

It is important to understand that when you call the IRS directly, you will talk to a junior IRS tax collector whose job is to collect information to use against you to collect on your full debt, even if you are experiencing financial hardship. Frontline collectors are NOT tasked with the responsibility of negotiating a lower settlement for you.

The Truth About

Your Tax Debt

There are approximately 8 million individuals and business owners who have tax debt, and the IRS is going after them with unprecedented levels of aggression – for instance, property seizures have increased by 230% in the last decade.

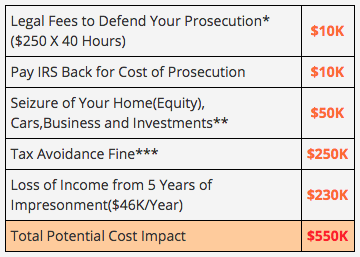

The IRS likely has access to all of your financial information, including both personal and business assets. They are also constantly mining social media data, travel, and credit card and debit transaction records. The IRS has begun to add delinquent taxpayers to the government no-fly list and may revoke your passport when you try to fly out of the country under a new law called FAST Act (section 7345 of the tax code). Collecting Tax debt takes priority over all your other legal rights, once the IRS is ready to move on your assets, you may lose your retirement funds, paychecks, home, cars, and even your business without much time for you to take action. The IRS has already begun to build their case against you. Evading tax debt comes at a heavy price: felony conviction, 5 years’ imprisonment, a $250,000 fine and the cost of prosecution.

It’s more important than ever to have an experienced professional who can take the IRS head-on by your side, armed with a vast knowledge of the tax debt law and IRS proceedings. Dealing with the IRS can be daunting, but with the right help you can get your life back on track and your financial house in order.

Avoiding Your Tax Issue is a Prosecutable Felony

Individual results may vary based on ability to save funds and completion of all program terms. Program does not assume any debts nor provide legal or tax advice. Read and understand all terms prior to enrollment. Not available in all states. Sources: ExpertLaw.com*, Bloomberg**,IRS**, Social Security Administration****

Why Choose Us

BBB Accredited

Over 12 Years of Relief

Experienced Staff

Highly Experienced teams of Licensed Enrolled Agents, Certified Public Accountants (CPAs) and Tax Attorneys.

Safe & Secure

Ideal Tax Solution is committed to providing a safe and secure site that you can trust. We take your privacy seriously. We do not sell or share your information with third parties.

Success Stories