Ideal Tax Solution

As seen in the news:

Tax Problems Are Heavy. Don't Carry Them Alone.

We are here to help!

Get help from the most experienced

Licensed Enrolled Agents, Certified

Public Accountants (CPAs) and Tax Attorneys.

Let a skilled tax specialist talk to the IRS

and stop them in their tracks while we build your

case and find a resolution.

Learn about the different programs you qualify

for and lower your debt obligation with the IRS

100% free consultation.

It’s hard to resolve IRS debt by yourself, as there are

Tax Court Findings, Revenue Rulings,

and Congressional Reports to consider.

You May Qualify to be Forgiven for Tens of Thousands of Dollars!

If you’re experiencing or worried about liens, levies, garnishments, or more, now is the time to learn about your options to protect yourself and resolve your tax burden. Tax debt reduction programs under federal law provide real relief, but they can be very complexed to navigate. We can help you solve your IRS related issues by leveraging the law in your favor and potentially can save you thousands of dollars.

It is important to understand that when you call the IRS directly, you will talk to a junior IRS tax collector whose job is to collect information to use against you to collect on your full debt, even if you are experiencing financial hardship. Frontline collectors are NOT tasked with the responsibility of negotiating a lower settlement for you.

THE TRUTH ABOUT TAX ISSUES

There are approximately 8 million individuals and business owners who have tax issues, and the IRS is going after them with unprecedented levels of aggression – for instance, property seizures have increased by 230% in the last decade.

The IRS likely has access to all of your financial information, including both personal and business assets. They are also constantly mining social media data, travel, and credit card and debit transaction records.

The IRS has begun to add delinquent taxpayers to the government no-fly list and may revoke your passport when you try to fly out of the country under a new law called FAST Act (section 7345 of the tax code).

Collecting taxes takes priority over all your other legal rights, once the IRS is ready to move on your assets, you may lose your retirement funds, paychecks, home, cars, and even your business without much time for you to take action.

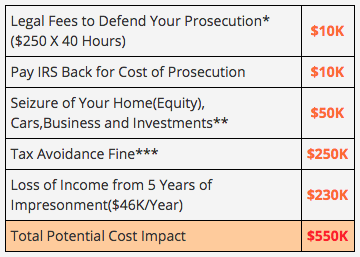

The IRS has already begun to build their case against you. Evading tax debt comes at a heavy price: felony conviction, 5 years’ imprisonment, a $250,000 fine and the cost of prosecution.

Ignoring the IRS may be very costly:

Avoiding Your Tax Issue is a Prosecutable Felony

Individual results may vary based on ability to save funds and completion of all program terms.

Program does not assume any debts nor provide legal or tax advice. Read and understand all terms

prior to enrollment. Not available in all states.

Sources: ExpertLaw.com*, Bloomberg**,IRS**, Social Security Administration****