IRS Writes Off Millions,

Solve Your Back Taxes Today!

Settle With the IRS Before They Take Action.

As seen in the news:

Tax Problems Are Heavy. Don’t Carry Them Alone

Our Tax Professional Will Work On Your Back Tax Filing Today!

Get help from the most experienced Licensed Enrolled Agents, Certified Public Accountants (CPAs) and Tax Attorneys.

Learn about the different programs you qualify for and see how our team can help you get you back on track – 100% free consultation.

It’s hard to resolve IRS issues by yourself, as there are Tax Court Findings, Revenue Rulings, and Congressional Reports to consider.

IRS ‘Fresh Start’ Qualification Assistance

If you’re experiencing or worried about liens, levies, garnishments, or more, now is the time to learn about your options to protect yourself and resolve your tax burden. Our IRS tax relief service can help you to use IRS tax debt relief program. IRS Fresh Start programs under federal law provide real relief, but they can be very complexed to navigate.

It is important to understand that when you call the IRS directly, you will talk to a junior IRS tax collector whose job is to collect information to use against you to collect on your full tax balance, even if you are experiencing financial hardship. Frontline collectors are NOT tasked with the responsibility of getting a lower agreement for you.

The Truth About Your Back Taxes And Our Tax Relief Services

There are approximately 8 million individuals and business owners who have outstanding taxes, and the IRS is going after them with unprecedented levels of aggression – for instance, property seizures have increased by 230% in the last decade.

- The IRS likely has access to all of your financial information, including both personal and business assets. They are also constantly mining social media data, travel, and credit card and debit transaction records.

- The IRS has begun to add delinquent taxpayers to the government no-fly list and may revoke your passport when you try to fly out of the country under a new law called FAST Act (section 7345 of the tax code).

- Collecting Taxes takes priority over all your other legal rights, once the IRS is ready to move on your assets, you may lose your retirement funds, paychecks, home, cars, and even your business without much time for you to take action.

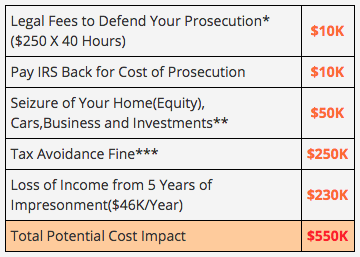

- The IRS has already begun to build their case against you. Evading taxes comes at a heavy price: felony conviction, 5 years’ imprisonment, a $250,000 fine and the cost of prosecution.

Dealing with the IRS can be daunting, but with the right help you can get your life back on track and your financial house in order.

Avoiding Your Taxes is a Prosecutable Felony

Ignoring the IRS may be very costly:

Individual results may vary based on ability to save funds and completion of all program terms. Program does not assume any outstanding taxes nor provide legal or tax advice. Read and understand all terms prior to enrollment. Not available in all states. Sources: ExpertLaw.com*, Bloomberg**,IRS**, Social Security Administration****

Why Choose Us?

BBB Accredited

Ideal Tax meets and exceeds BBB Accreditation Standards which include a commitment to make a good faith effort to resolve any consumer complaints.

Over 10 Years of Relief

Ideal Tax is one of the oldest and most respected Organization In Tax Resolution. We have been helping Taxpayers against the IRS longer than anyone else.

Experienced Staff

Ideal Tax meets and exceeds BBB Accreditation Standards which include a commitment to make a good faith effort to resolve any consumer complaints.

Safe & Secure

Ideal Tax is committed to providing a safe and secure site that you can trust. We take your privacy seriously. We do not sell or share your information with third parties

Success Stories

Laura S.

I Finally Have My Life Back!

Many thanks to Ideal Tax Solution for resolving my tax problems! It feels as though I’ve been set free, without all the fear and heaviness I was feeling! I was overjoyed when I received my letter from the IRS that they accepted my offer! This is a legitimate company that I will recommend to anyone, no matter what your tax situation is. What a Christmas present!

David M.

Professional And They Follow Through

I believe in education. I am a doctor with an MBA. In my world when I started to make money I did not make the right withholding and the IRS has liened my check from the hospital, $5000 a month. At first you may think that a doctor can afford this but it is ridiculous, I cannot nor should I be expected to try to pay penalties that not even a doctor could catch up with. I can tell you after thorough investigation Ken at Ideal Tax is utterly professional, fair and most of all expert with all these tax matters. Not only did he lift the garnishment from the hospital, I am in a more favorable arrangement with the ruthless organization called by the acronym IRS. I will give 5 stars because he took the time to handle my case while communicating with me very well.

Regina B.

They Will Help You!

My husband was ex-military and he didn’t file the right dependents because his ex-wife took the deduction or something like that. Now that we are married the IRS came after me for what his wife did to him. I thought about getting this done once and for all and called Charlene and she helped me right away. Because I got a letter stating they would lien usresent!

Linda L.

Highly Recommended!

I signed my contract with Ideal about a month ago and couldn’t be more pleased with my experiences with this company so far. They were able to get me into a safe status with the IRS and they are working on an offer. I have been very impressed, I thought everything would take much longer! Thank you, thank you, thank you for all your help. communicating with me very well.

We’ve Got Your Back

When the IRS has such a relentless hold on your life, it’s easy to feel utterly powerless. Our mission is to help you restore your life. The IRS is a fearful agency, but they understand that they need to offer taxpayers the opportunity to pay what they can afford, while still allowing the taxpayer to care for their needs.

Here’s the good news – you may be able to leverage tax court findings, revenue rulings, and congressional reports to reduce your tax responsibility. It’s never easy, but by working with a tax resolution expert you can restore your life.